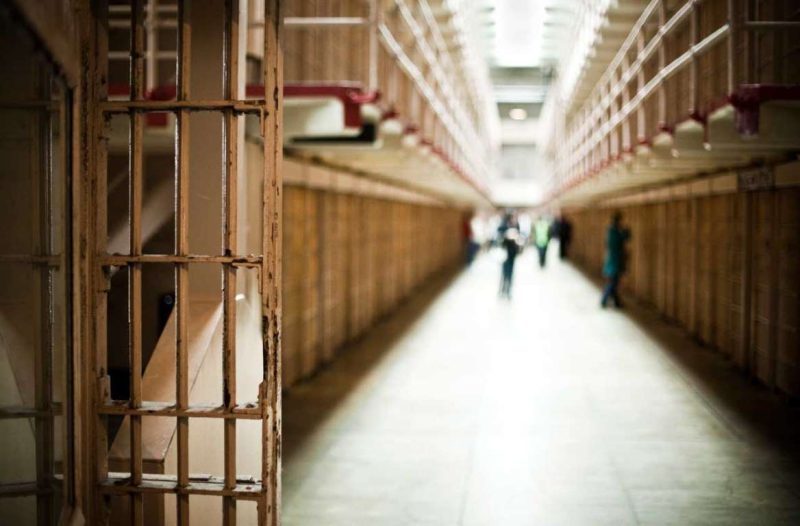

COMPENSATION FOR BEING (WRONGLY) LOCKED UP

With exonerations on the rise, thanks in part to advances in DNA testing that have helped the wrongfully incarcerated win their freedom, Congress has taken a step to make amends as well. Compensation that these victims receive is now fully exempt from federal taxation. The change came with tax-law changes Congress put into place at the end of 2015.

PLAYING BASS

An accomplished bass player and music professor laid a major beatdown on the IRS. He traveled to jazz rehearsals and performances to keep his skills sharp so he could play with other well-known musicians. The IRS said he could not deduct his travel costs because he enjoyed playing the bass and performing wasn’t part of his teaching duties. Nevertheless, the Tax Court allowed him the write-off because he translated what he saw and heard in the music scene and taught it to his students.

BEING A STARVING ARTIST

This deduction is both obscure and listed right there on Form 1040. If you are a “performing artist,” you have the ability to deduct business expenses related to your work, even if you don’t itemize—it’s one of the rare “above the line” tax deductions.

But before you dance an extra little jig, note the considerable restraints on this deduction: You have to have at least two employers (not gigs—actual W-2 income), and each has to pay you at least $200. Your expenses have to be at least 10% of what you make as a performer. But here’s the real kicker: Your adjusted gross income can’t be more than $16,000, even if you’re married.

Why so low? The value was set in 1986 and has never been adjusted for inflation.