BARKING DOGS

A self-employed consultant who worked in her condominium sued her neighbors and the condo association, alleging that her work was disrupted by noise from faulty construction and barking dogs. Also, in connection with the litigation, she was charged with a criminal misdemeanor. She deducted $26,000 of attorney fees associated with both of these proceedings as business expenses.

The IRS said the legal fees were personal costs. But the Tax Court OK’d half of the write-off because she used 50% of the condo for business, and the IRS failed to prove that the noise didn’t adversely affect her business use of the residence.

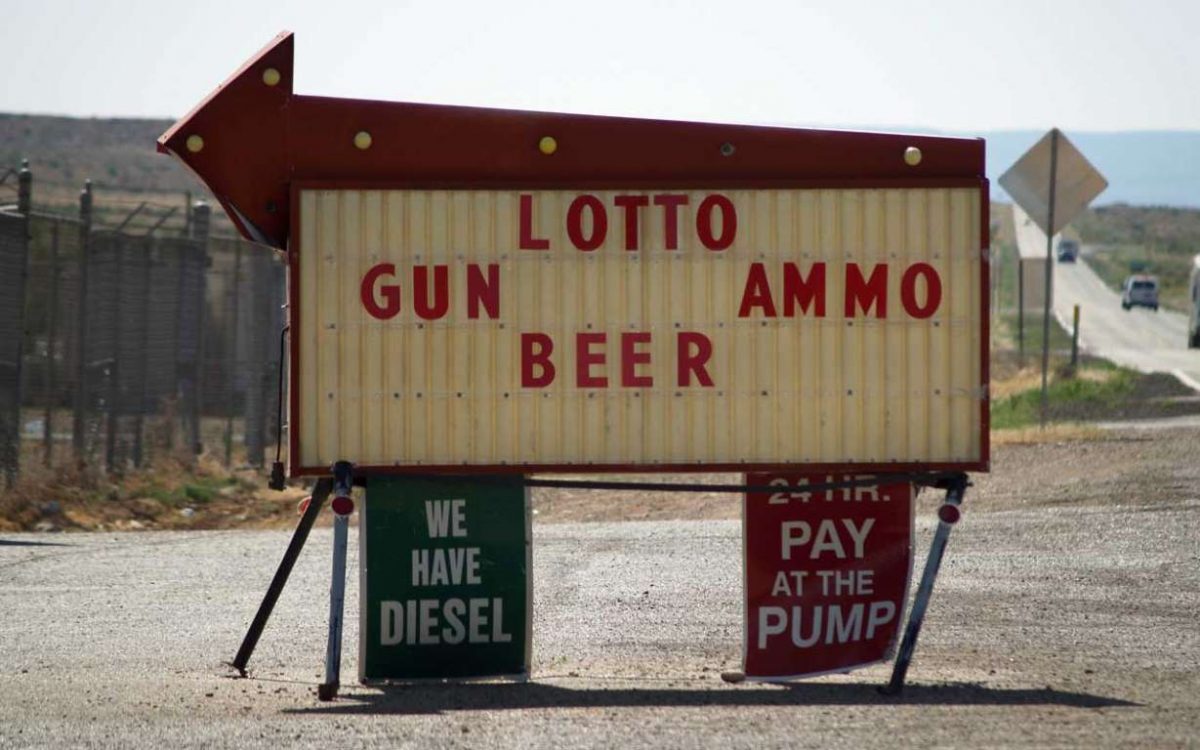

FREE BEER

In a novel promotion, a service-station owner offered his customers free beer with a fill-up. Not surprisingly, his station’s gasoline sales increased significantly. Proving that alcohol and gasoline do mix—for tax purposes—the Tax Court allowed the owner to deduct the cost of the beer as a business expense.

MAKING MOVIES

A lawyer faced a challenge from the IRS as she sought to deduct losses during the six years she spent making a documentary film on the musical group Up With People. The IRS claimed the long series of annual losses indicated that her filmmaking activities were a hobby, asserting the project was essentially a high-cost home movie because her husband once was a member of that group.

Furthermore, at one point during hearings, the judge reviewing the case suggested that documentary filmmaking is by nature not-for-profit—a musing that so alarmed the film industry that a number of well-known filmmakers filed friend-of-court rulings to say, in essence, that you can make money with documentaries.

Ultimately, the court ruled in her favor, allowing her deduction of six-figure losses. It noted that she acted in a businesslike manner, hiring staff such as a bookkeeper, buying insurance, consulting experts, changing the story line to make the film more marketable, blogging about it, and taking it on tour to movie festivals.